VIEW BY CATEGORY:

Hi, we're Hunter and Sarah, a husband-and-wife, luxury wedding photography team. We’re also educators, helping other photographers build profitable and sustainable photography businesses.

MEET US

LOOKING FOR SOMETHING?

4 Reasons Why Small Business Owners Need a Personal Budget (It’s Not What You Think!)

April 20, 2023

—

Hey photographer friends! Welcome back to our Photography Blog, Mastering the Wedding Photography Biz with Hunter and Sarah! Today, our goal is to convince you that, if you’re a small business owner, you need to be keeping a really good eye on your personal finances. While there are a ton of reasons why a personal budget is helpful, we’ve found that these four reasons are specifically helpful for small-business owners and solopreneurs, like us and many of our portrait and wedding photography students. So let’s jump in!

1. A Personal Budget Helps You Focus on What’s Important

The third reason why we think small business owners — and especially portrait and wedding photographers — can benefit from a personal budget is because of how it helps you to stop stressing about money, and stay focused on what’s most important. Whether you’re a small business owner or not, money stress is real. But it can be especially severe for us self-employed people, who have a much more direct relationship between the work we put in and how much we make each month.

But the way that budgeting helps you get your personal finances under control can relieve so much of the stress around money, allowing you to focus on running a successful business and enjoying the life with your friends and family that that business allows, rather than constantly being stressed about money.

And if the idea of creating a budget for your personal finances sounds stressful, trust us on this one: having a plan and working on sticking to it is way less stressful than just hoping each month that you spend less than you make. In fact, if talking or thinking about money fills you with anxiety, it might sound counterintuitive, but making a personal budget can actually be one of the most freeing things you can do, and can start to break some of those negative thought patterns you may have around money.

2. Your Personal Budget is the Same as Your Business Profit Goals

The first reason that we believe all small-business owners — and solopreneurs especially — need a personal budget is because how much you need to take home each month is really determined by your personal budget. And how much you need to take home each month is another way to talk about your business’ “net profit” each month!

Now, if that sounds like a lot of financial jargon, stick with us. Let’s take this back a step. A personal budget is basically a plan of how you’re going to spend and save your money each month. At its most basic level, it’s a list of all the bills you’ll owe each month, the amount you want to save for any given purpose, and the amount you plan to spend on yourself. So it’s things like your rent and your cell phone bill, it’s saving up for when your car inevitably needs some work done, and it’s how much you’re going to let yourself spend on eating out or buying new clothes.

And when you add up all of those numbers, you end up with one big number that you’re going to spend and save each month. And that number is essentially what your paycheck needs to be each month! When you work for someone else, your personal budget is determined by what you make. If I get $2,000 in my paycheck, every two weeks, then I can spend and save up to $4,000 each month. But when you’re self-employed, you can actually work backwards! You can start with what you want to spend and save each month, then work until your business makes that much.

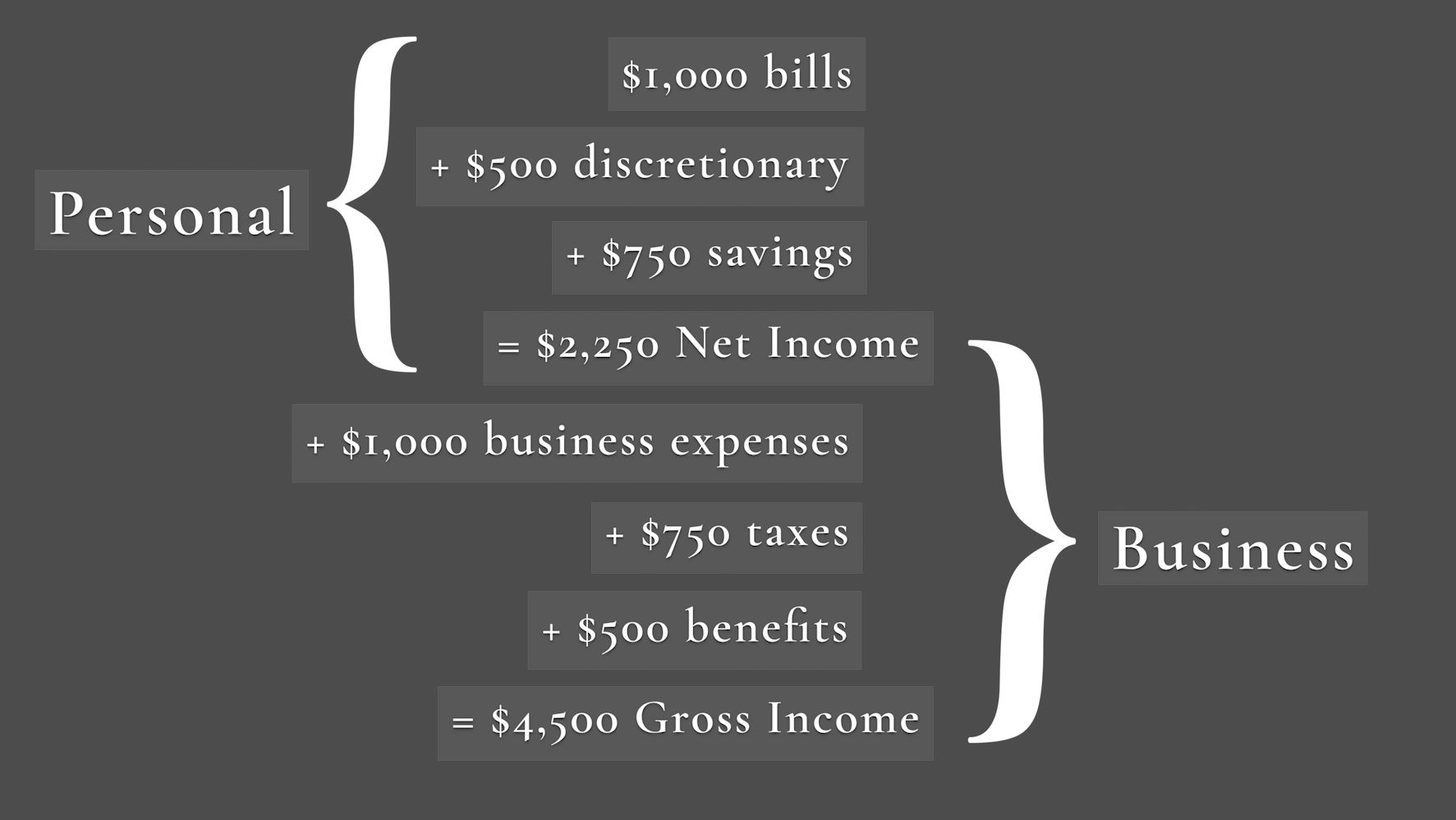

For example, let’s say that you make a personal budget, and determine that you have $1,000 in bills each month for things like your mortgage payment or your gym membership, you’re going to spend $500 on discretionary items like eating out with friends and buying groceries, and you’re going to save $750 per month so you can go on a vacation next year or buy presents for your friends and family when the holidays come around. That adds up to $2,250 per month ($1,000 + $500 + $750 = $2,250).

So now, you know exactly how much money your business needs to net each month. But keep in mind, that doesn’t mean your business needs to bring in a total of $2,250 each month. As we’ve talked about before in our past Workshops, you’ll need to account for things like your business expenses, your taxes, and any benefits (like health insurance) that your business will need to pay for. So your business might actually need to make more like $4,500 each month so that — after you pay your taxes and expenses and insurance — you can pay yourself that $2,250 you need to live on.

3. A Personal Budget Helps Keep Things Separated

Another reason why we think a personal budget is going to help out any small-business owners out there is because it forces you to be more vigilant around what you spend. And when you’re paying close attention to all the money that comes in and out, you can catch yourself when you mix up your business and personal finances!

Nothing will create a bigger headache come tax season for you and your accountant than mixing up your personal and business finances. If you accidentally accept payment from a client directly into your personal checking account instead of your business account, or if you charge business expenses to your personal credit or debit card instead of to your business credit or debit card, it can make your accounting and your bookkeeping incredibly complicated.

And worse than making things complex, it can lead to missing business expenses altogether, meaning you end up paying more in taxes than you should! That’s like making a free donation of your hard-earned money to your government for no reason other than you weren’t paying close enough attention! However, if you’re keep track of your money each month, categorizing all your personal expenditures and making sure you’re hitting your spending and savings goals, you’ll notice right away if business money is getting mixed with personal money. This will allow you to correct the issue right away, rather than only noticing once each year when you’re getting ready for taxes!

4. “You Can Only Manage…”

The fourth reason that we think that solopreneurs need a personal budget is related to this old business adage (that’s sort of loosely attributed to management expert Peter Drucker): “You can only manage what you can measure”. In other words, if your personal finances aren’t being measured, then you really don’t have any concrete way of getting control over your personal financial life.

In fact, we shared last week that you can have the most successful small business in the world, but if your personal finances are a mess, you’re always going to be stressed, no matter how much money you make. And when it comes to getting your personal finances in order, budgeting is always the first step. If you want to get out of debt, pay off student loans, save for a house or for retirement or pay for your kids’ school — or even just not feel guilty every time you buy something for yourself — budgeting is always going to be the first and most basic step you can take.

So if your idea of a budget is currently “I try to spend less than I make each month, and hope my checking account never hits zero”, that’s a recipe for stress and anxiety, not a recipe for financial security or building wealth. And if you’re a photographer who is hoping to one day quit whatever you’re doing right now and fully support yourself or your family from your photography business, then this goes triple for you. If you joined our coaching program and met with Sarah and I every week or two, and told us you wanted to go full-time, getting you on a personal budget and building a strong foundation in your personal finances is one of the very first things we’d do with you.

However, we know that not everyone can afford to hire us for hundreds of dollars an hour to participate in our coaching programs. That’s why last week, we announced our upcoming workshop: “Personal Finance: Budgeting, Saving, Debt, and Investing (For People Who HATE Talking About Money)!” More info here!

Not only are we going to talk a bit about the psychology of money and how it can be holding you back, but we’re going to get super practical when it comes to building a budget and living on it in a way that doesn’t feel like you’re being punished, but also allows you to use your income to build wealth and stay out of debt! And alongside budgeting, we’re also going to be teaching about saving, paying off debt, and we’re even going to cover the very most basic strategies when it comes to investing for retirement, which is way simpler and way more important than you probably think it is.

And as with all of our workshops, if you purchase your ticket before we go live at 7:00 PM ET on Tuesday, April 25th, 2023, then you can get access to the live workshop, as well as unlimited replays of the recording, for HALF PRICE, and you’ll also get access to our own budgeting spreadsheet template!

However, even if you can’t make it to the live workshop or if you’re watching this video after April of 2023, we hope you’ll still consider clicking this link in order to learn more about this workshop, because the replay of us teaching on all of this really powerful content will be available indefinitely once we’ve hosted the workshop live!

Want More?

Click HERE to get your free copy of our eBook: “5 Essential Tips for Turning your Side-Hustle into a Full-Time Photography Business.” You’ll also be subscribed to our newsletter, so our newest content, weekly encouragement, and exclusive offers will be delivered right to your inbox!

Filed in:

Wedding Photography & Photography Education

Charlottesville, Virginia and Beyond

HOME

ABOUT US

WEDDINGS

JOURNAL

FOR PHOTOGRAPHERS

PRESS & PRAISE

BLOG

CONTACT

e. hunter@hunterandsarahphotography.com

p. (434) 260-0902