VIEW BY CATEGORY:

Hi, we're Hunter and Sarah, a husband-and-wife, luxury wedding photography team. We’re also educators, helping other photographers build profitable and sustainable photography businesses.

MEET US

LOOKING FOR SOMETHING?

Most Common (And Costly!) Mistakes When it Comes to Photography “Business Expenses”

April 27, 2023

—

Hey photographer friends! Welcome back to our Photography Blog, Mastering the Wedding Photography Biz with Hunter and Sarah! If you’re confused or unfamiliar with the idea of “business expenses” for your new photo business, then keep reading this blog! Today we’re going to dive into the basics of what a photography business expense is, why you need to keep track of them, and even the most common mistakes that photographers make when it comes to tracking the expenses of their business.

What is a Photography Business Expense?

So, let’s start off with a simple definition of a business expense: a cost incurred in the ordinary course of business. In other words, a business expense is anything that your business spends in order to keep running and operating. Last week, we talked about why we believe business owners need a personal budget. It’s really important to keep in mind right at the start of this post that your personal finances and your business finances should be totally separate if you’re running a real business!

However, if you’re just getting started and are still building your portfolio or have barely been getting paid for your work, then it’s no big deal if all your money is in one place, because you aren’t technically operating a real business yet. But if you’re making more than a few hundreds dollars per year from your photography business, then you really should make your business legit and legal, and start tracking your business expenses, making sure that they’re being paid for from a business checking account or with a business debit or credit card.

If you’re paying for a new camera or lens, a subscription to Adobe Lightroom, or a website builder like ShowIt or Pixieset, then these are obviously business expenses, and should be kept separate from personal expenses like your groceries, your family vacation, and that dinner you had with friends the other night. And we’re going to jump into the specifics of business expenses later in this post! But first, let’s talk about why keeping track of your business expenses is so important.

Why You Need to Keep Track of Photography Business Expenses

The #1 reason you need to keep track of your photography business expenses is for tax purposes. Basically, what your business spends to keep running will not be counted against you when the time comes to pay your taxes. In other words, when you go to pay your state and federal income taxes, you’re going to owe a percentage of what your business made each year. There’s no getting around that. However, the number that you’re going to be taxed on is your “gross business income” — or the overall money you take in — minus your (tax-deductible) business expenses! This is also called your net profit.

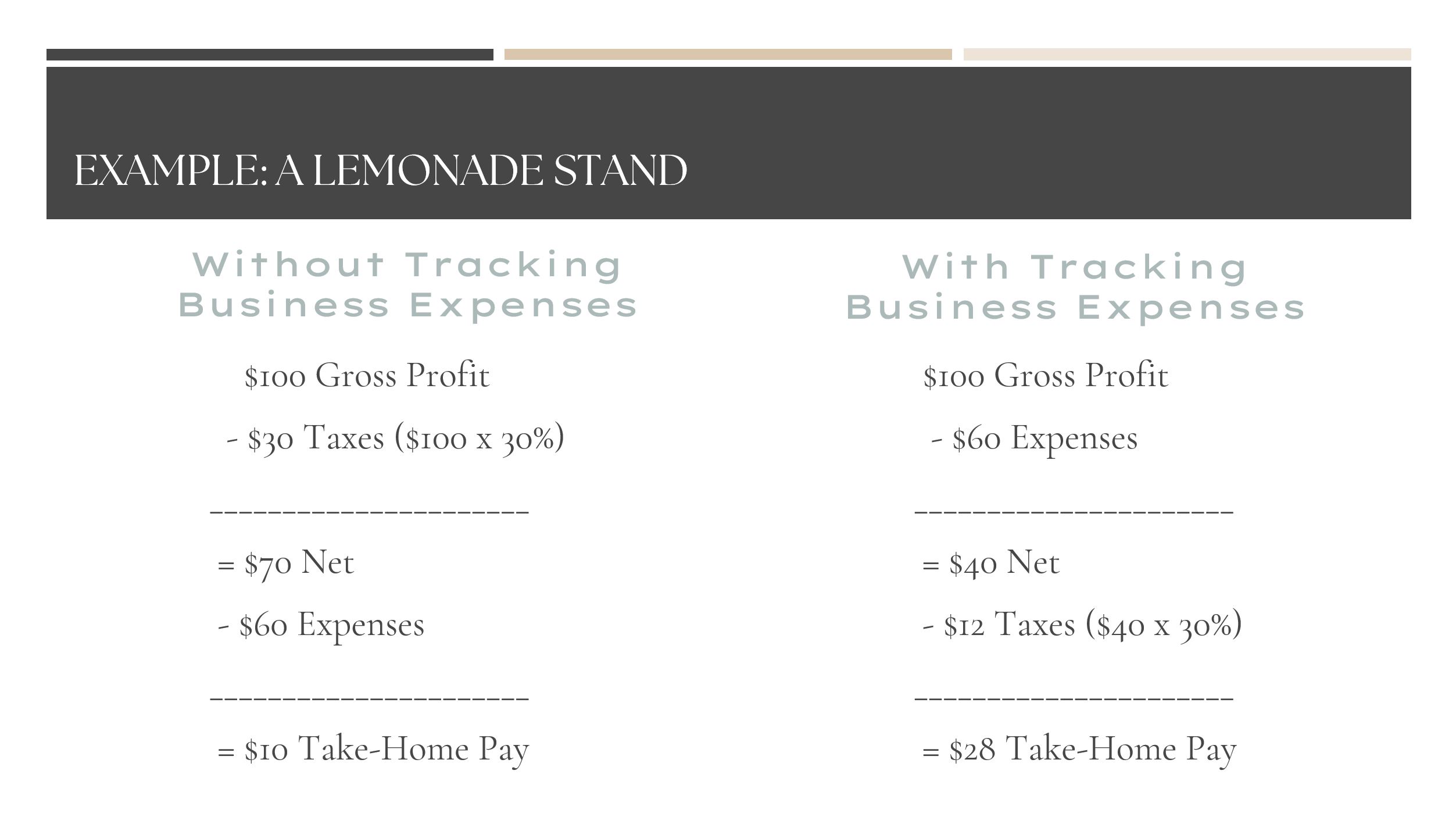

A Lemonade Example

And here’s why that difference is important. If you were to run a lemonade stand for an afternoon, you might make $100 by selling 100 cups of lemonade to your neighbors for $1 each. So when the IRS came knocking at your lemonade stand, they’d say, “Hey, you owe us X% of all the money you made today!” However, if you’re a smart lemonade-stand owner, you know that you spent $20 putting up your lemonade stand, $20 on paper cups, and $20 on lemons and sugar. So even though you were paid $100 — that’s your gross business income — that doesn’t mean you made $100. Once you subtract your business expenses, your actual “net profit” was only $40.

And here’s why this is super important. Let’s say that the government was asking for a 30% cut of your income (which isn’t an unreasonable number for a self-employed individual). If you weren’t keeping track of your business expenses, and just told the government, “Hey, I made $100!”, then you’d owe them $30 of that. But whether you were paying attention to and tracking your business expenses or not, you did have to buy the lemonade stand and the cups and the lemons and the sugar. So at the end of the day, you’re only going to walk away with $10. Not much to show for a full day’s work! But if you were tracking your expenses, when the government came knocking for their 30% cut, you could tell them that you net $40. So their cut is now $12, leaving you with $28! See the example spelled out below.

Tax Savings Add Up

And while the difference between $10 and $28 might not seem like much, keep in mind that jumping from $10 to $28 is almost TRIPLING the amount of your OWN hard-earned money that you get to take home at the end of the day. And if we multiplied those numbers by 2,000 (so they were scaled up to the level of a real small business), suddenly the difference between taking home $20,000 at the end of a year, and taking home $56,000 at the end of the year seems like a lot!

Now, if all of this feels overwhelming and confusing, or if you haven’t even done the work of setting your business up legally with an LLC or a business bank account, then you might benefit from a more foundational understanding of the basics of how a business work. Learning about establishing an LLC, plus the basics of income, expenses, taxes, contracts, etc. might sound boring, but it’s also essential for anyone who wants to run a real business one day!

And if you’d like to learn some of these things from us, then we’d encourage you to check out the workshop that we hosted last year called “Photography Business Basics – Setting up a LEGIT and LEGAL Photography Business!” The recording of the entire 2-hour workshop is for sale on our website!

You can click HERE if you’d like to learn more about our workshops!

Common Business Expense Mistakes

Now, as promised, let’s hit really briefly on a few common mistakes when it comes to photography business expenses.

1. Meals (Meetings Only)

The first mistake is thinking that anything you can justify to yourself as “for business use” suddenly counts as an expense. As you probably could’ve guess, the federal government doesn’t want to let anyone who owns a business just write off anything they want. So the rules surrounding what is and isn’t a business expense are pretty specific.

For example, if you go to a café to get some work done, editing photos or sending emails, and buy a coffee or a sandwich while you work, that is not a business expense. If it were, then everyone who is self-employed would probably write off every single meal they ever purchase. However, if you take a client out to coffee while you sell them on hiring you for your wedding photography services, or if you have a meeting with your accountant over lunch, since those are business meeting, some or even all of that meal may be tax deductible.

2. Clothing (Branded Only)

A mistake that we made early on in our business was thinking that any clothes that we bought specifically to photograph weddings in would count as an expense. Now, we have almost nothing in our lives that requires Hunter to wear a suit, other than photographing weddings. So when we bought a $500 suit that was dry-fit and stretchy and perfect for those long, hot wedding days, we thought that We would be able to business expense it.

But only clothing that is either branded with your company’s logo, or 100% cannot be used for personal use can count as a business expense. So a professional beekeeper could business expense a beekeeping outfit and a professional sports team can business expense their jerseys, but a nice outfit or cute clothes that you can also shoot in do not count as a business expense.

3. Using Your Car

Now, inevitably, there are going to be certain areas of your life where your business and your personal life intersect, and your car is a really good example of this. We don’t know any self-employed photographers who bought a car 100% on their business that sits in their driveway all the time, and they only take it out to drive to photoshoots and weddings. In all likelihood, you have a car that you personally own, that you also use for work. And the easiest way to figure out how to business expense this, is to track every single one of your miles, and determine what % of the car’s use is for business purposes. So if you drive 10,000 miles in a year, and 4,000 of those are for work, then 40% of your costs associated with that car are tax-deductible.

Then, you can either do a complicated calculation where you take that 40% and multiply it by every gas fill-up and oil change and new set of tires, OR you can just take the standard mileage deduction, which is as of this recording, $0.655 per mile, multiplied by those 4,000 miles you drove for work. There are several apps that will help you keep track of this. We’ve used MileIQ for the last 5 years, which costs $60 a year, but has allowed us to write off an average of $4,000 worth of mileage expenses each year.

4. Home Office & Utilities

Another area that has crossover is your home. If you’re like most photographers, you run your business out of your own home: editing photos, emailing clients, and generally managing your business from home office. Now, if the room that you work in is used exclusively for your business, then you can write off a percentage of all of your housing costs relative to that room’s size in your home. So if you live in a 1,000 square-foot apartment, and your home office is 300 square-feet, then you are typically allowed to write a 30% of your overall housing expenses: your rent or mortgage, homeowners or renters insurance, utilities, internet, etc.

However, your home office must have 4 walls and a door (i.e. be its own, self-contained room), and be devoted solely to your business. If your desk is in your bedroom, or you work on a laptop sitting on the couch in your living room, you don’t actually have a dedicated space, and none of your housing costs are tax-deductible.

5. And (SO) Much More!

Now, There are a ton of other examples, many of which we get into in our Photography Business Basics Workshop. But ultimately, our most important advice is to make sure that you always check with a tax professional or certified public accountant, because the laws where you live may be totally different from where we live, or they may have even changed since we produced this video!

Want More?

Click HERE to get your free copy of our eBook: “5 Essential Tips for Turning your Side-Hustle into a Full-Time Photography Business.” You’ll also be subscribed to our newsletter, so our newest content, weekly encouragement, and exclusive offers will be delivered right to your inbox!

Filed in:

Wedding Photography & Photography Education

Charlottesville, Virginia and Beyond

HOME

ABOUT US

WEDDINGS

JOURNAL

FOR PHOTOGRAPHERS

PRESS & PRAISE

BLOG

CONTACT

e. hunter@hunterandsarahphotography.com

p. (434) 260-0902